- Quickbooks desktop payroll tax missing from schedule manual#

- Quickbooks desktop payroll tax missing from schedule download#

Quickbooks desktop payroll tax missing from schedule manual#

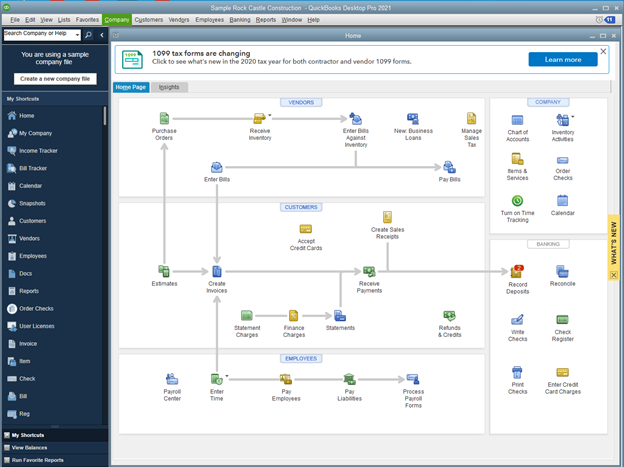

l was able to set-up a QuickBooks 2018 Sample File for manual payroll using my 12 steps without any problems at all. So I decided I would try it out, and it worked without a hitch. Well, someone wrote in a week or so ago saying they couldn't get 'manual payroll' to work for QuickBooks 2018 using the articles in my earlier 12-step articles. In 2013 I wrote one of our all time favorite articles called '12-steps to manual Payroll in QuickBooks', then in 2014 I revisited the topic to insure that QuickBooks 2015 would also permit the manual payroll option to be used. For companies offering 401(K)s and other retirement benefits to employees, this is a task that is often best left to the professionals.ĭo you need help with QuickBooks, payroll or other accounting software? We would be happy to help! Contact Eric or Todd here.Each New Year a lot of people using QuickBooks try to decide if they are going to renew their 'payroll subscription', or if they can somehow use QuickBooks for manual payroll. There is an EZ Setup option to streamline the process, but it does not allow for customized settings. While certainly possible, less experienced users may find setting up 401(K)s difficult in Payroll. Inactive employees can also contribute to this bogging down depending on how many of them are still saved in the system. The system can slow down significantly while running reports and processing payroll as more employees are added. While Payroll does not have strict employee caps or limits across tiers, like some other payroll platforms, the more employees a business has, the more likely it is to experience performance lags. However, it does underscore the importance of staying abreast of available updates and practicing proper account upkeep. These limits are tied into the tax table, so they do not need to be manually modified. If there is a chance that payroll processing may be delayed from time to time, consider upgrading to a plan level that offers the option of same-day direct deposit.Įver-changing wage base limits must be updated annually when using QuickBooks Desktop. As a result, disorganized or improperly managed payroll efforts can create a ripple effect, delaying direct deposits to employees, and causing them to receive their wages late. Payroll direct deposits must be submitted a day in advance. As is typical with bank integrations, there is a cutoff for direct deposit processing. Not only is direct deposit limited in amount, it is also constrained by timing for the lowest level Payroll plan.

When setting up QuickBooks Payroll, take the time to look at what payroll totals and individual amounts are typically to anticipate these types of issues ahead of time. However, business owners may not even realize that these limits exist when they are getting started, making them unexpected and inconvenient when they are encountered. Ultimately, restrictive direct deposit limits can be fixed. While an increase request may take several business days to be reviewed, it is the best long-term solution. Businesses hitting direct deposit limits can choose to pay employees with checks, pay staff smaller amounts on a more frequent payment schedule, or request an increase. Payroll includes direct deposit limits to protect against fraud however, these restrictions can thwart legitimate payment efforts. This kind of redundancy is a recommended best practice anyways, making it a salient point even if owners and managers expect to always have access to high-speed internet. To avoid payroll lags due to internet speed issues, business owners should have the protocols in place to allow other employees to run payroll on their behalf when they are out in the field or on vacation. This can cause payroll timing issues while traveling for work or pleasure. When working in areas of the country where internet access is slow or spotty, Payroll may not be able to run.

Quickbooks desktop payroll tax missing from schedule download#

It may seem obvious to mention that QuickBooks Payroll requires high-speed internet access to download the latest payroll tax rates, but it is important to remember. Filling the gaps may require additional software, third-party services, or increased in-house employee responsibilities to ensure timely, accurate payments and benefits management.

It is important to understand what QuickBooks Payroll is missing to enable more strategic decision making across the organization.

0 kommentar(er)

0 kommentar(er)